GROW YOUR BUSINESS, ACHIEVE YOUR DREAMS.

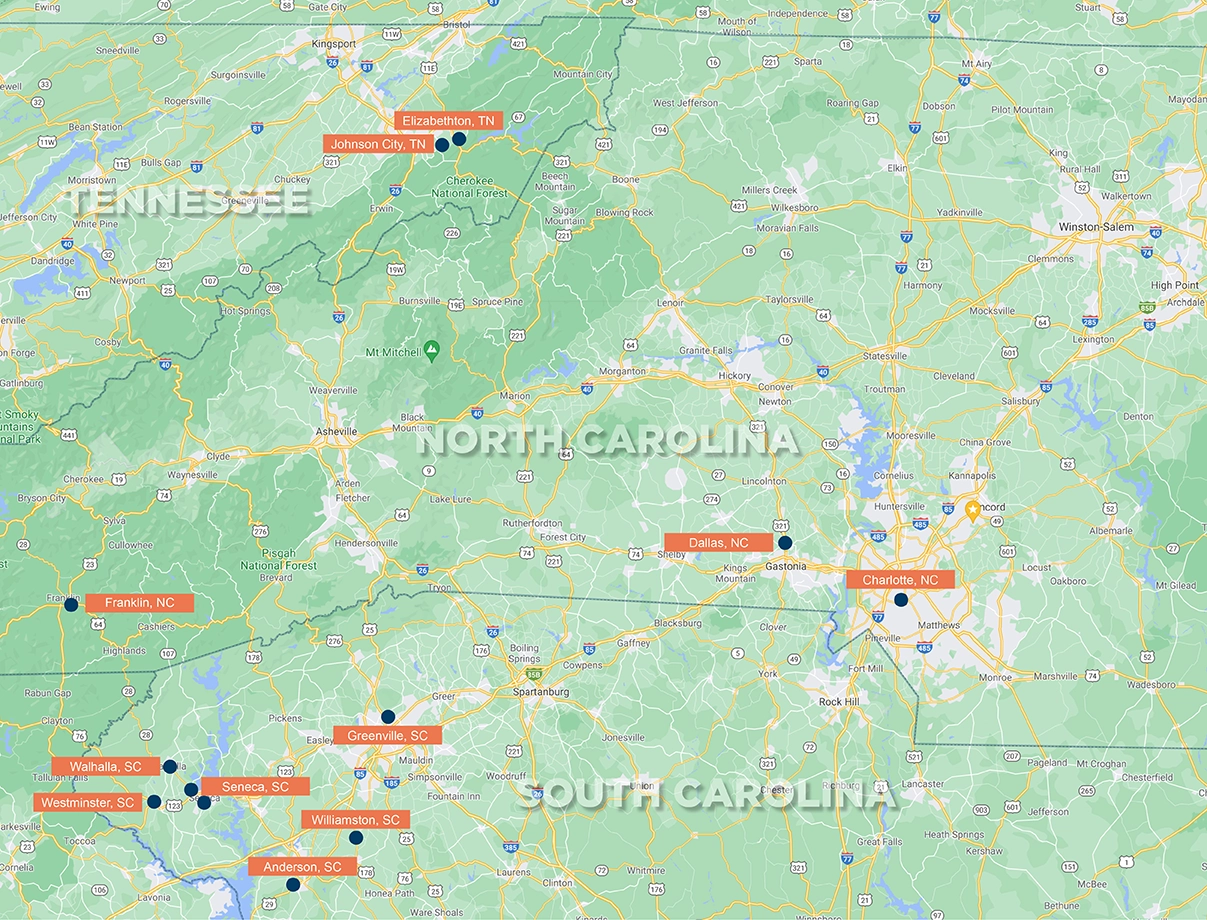

Small business is the cornerstone on which every community is built. We’re here to help local business owners and entrepreneurs pursue their American dream. We offer traditional SBA loans, specialty lending programs, and the expertise to guide and support you every step of the way.

The Small Business Administration

A smarter way to borrow money for your business.

Goals of the SBA

- Preserve free competitive enterprise

- Protect the interests of small business in America

- Maintain and strengthen the economy

- Provide free entrepreneurial development for small business owners

- Help small businesses win government contracts

- Provide financing options from microlending to equity investment capital

For Business Owners and Entrepreneurs

Since 1953, the United States Small Business Administration has been the only cabinet-level federal agency dedicated to helping American entrepreneurs to achieve their business dreams. See what the SBA can do for you.

- Loans suited for your specific business type

- Flexibility to meet your unique challenges and goals

- The capital you need to grow

- Free counseling and low-cost training

The nation’s only go-to resource designed just for small businesses. Get the expertise and funding you need to achieve your business goals.

Start earning more from what you’ve got. Contact us to open a Business Certificate of Deposit today.

CAPITAL

LOAN COUNSELING

ADVOCACY

SBA PROGRAMS

Turn your dreams and plans into reality with the SBA’s two most popular programs. Get guidance and support to determine the capital you need.

SBA 7(a) Program

The SBA 7(a) Loan Program is the Small Business Administration’s primary program for assisting both new and existing small businesses. Funds are available for a wide range of business purposes.

SBA 7(a) LOAN TYPES

- Standard 7(a) – Borrow up to $5 million with an interest rate that does not exceed the SBA maximum

- 7(a) Small Loan – Borrow up to $350,000 with no collateral required up to $25,000

- SBA Express – Accelerated program where the SBA will respond to your application within 36 hours

- Export Express – Expedited program for exporters with loans up to $500,000

- Export Working Capital – Program designed to help exporters get working capital to export goods

- International Trade – Long-term financing for the expansion of international sales

- Veterans Advantage – Reduced fees for certain veteran owned businesses

- CAPLines – Helps small business meet short term or cyclical working capital needs

SBA 504 Loan Program

Designed to promote economic growth and create new jobs, the SBA 504 Loan Program provides an alternative path for businesses to receive financing.

Approved small businesses that operate for profit may receive long-term, fixed-rate financing for expansion or modernization of their enterprise.

- Purchasing a fixed asset such as real estate or buildings

- Acquisition of new machinery, furniture, or equipment

- Renovation, remodeling, or updating of facilities

- Land or land development

SBA Disaster Assistance Loans

Low-interest disaster loans are available through the SBA to help businesses and homeowners recover from declared disasters.

Our SBA lending team at Community First Bank knows what it takes to help qualifying businesses get the capital they need. Contact us to find out how we can guide and support your business through the process of securing a small business loan.

“THROUGH OUR PERSONAL RELATIONSHIPS WITH COMMUNITY FIRST THEY HAVE BEEN VERY HELPFUL IN US GROWING OUR BUSINESS.”

– ERIC MCCOLLUM, OWNER, DEEP SOUTH DEFENSE